Perennial Brand over Current Creativity: Lessons from Q1 2024

First quarter results offer a glimpse into the dynamics shaping the luxury market in 2024.

My key takeaway: Consumers buy ultra-luxury and novelty when they are rooted in a desirable brand.

Let’s dive into some details:

Ultra-luxury defies uncertainty - Hermès, Loro Piana, Louis Vuitton

Brands like Hermès and Loro Piana showcased dynamic growth, with Hermès reporting a solid 13% increase in revenue. LVMH’s recognition of Loro Piana as “excellent” further underscores the strength of this segment. LVMH as a whole only grew by 3%, the fashion & leather goods group, encompassing 14 brands, by 2%. The slowing of luxury’s largest player gives some sense of direction for the rest of the industry. Out of the LVMH brands next to Loro Piana only the larger-than-life Louis Vuitton was described as “excellent”.

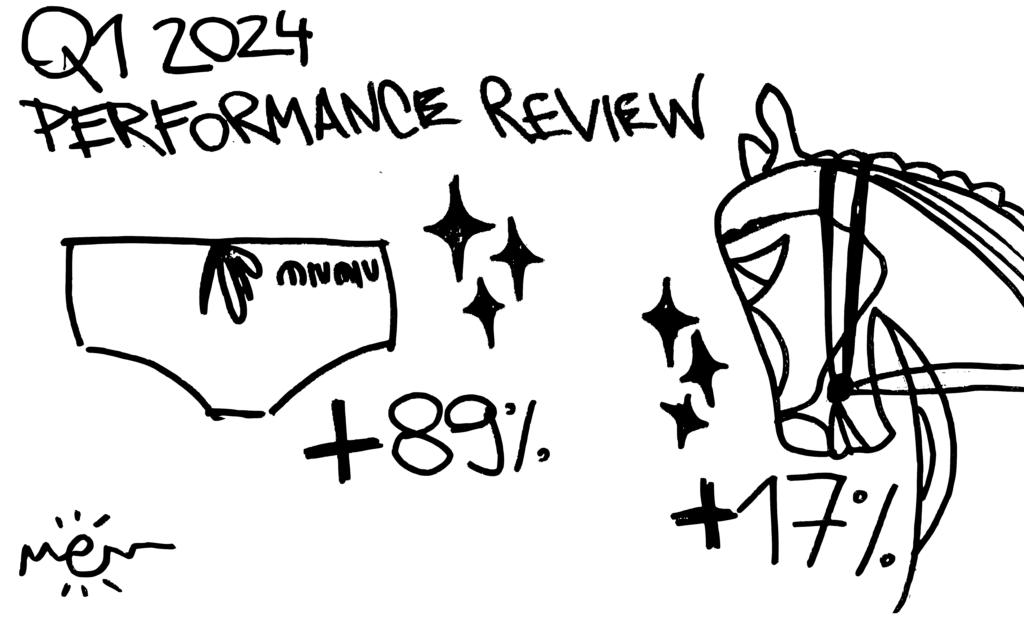

Novelty and trendsetting create necessary drag - MiuMiu

Next to high-end appeal, novelty is still pulling in consumers. MiuMiu is experiencing significant growth after a strong reception at Paris Fashion Week. It leads Lyst’s Index for Q1 2024. The increased interest in the agenda-setting women’s collection, the discovery of newly launched men’s line as well as a high-end price point, hand the Italian brand a stunning growth of 89% in Q1. MiuMiu is exciting, it gives customers access to a playful yet ultra-cool identity and its connections to perennial brand Prada anchor it as trendy yet timeless.

Pushed by the MiuMiu explosion the Prada Group grew by 16%.

Kering's transformational journey will take time

Kering faced a 10% decline which management attributed to its strategic overhaul. While initiatives like raising prices and focusing on self-owned retail show promise for brands like Bottega Veneta, challenges persist.

Yves Saint Laurent is not as successful at implementing its price hikes. It is pulling back from wholesale with the goal to increase exclusivity, yet retail sales also dropped by 4%.

Gucci witnessed a substantial revenue drop of 19%, signalling a need for speed (in delivery) to regain momentum. In the duality of desirability and novelty it is exactly the latter, that Gucci is missing right now. In the Webcast to Kering’s Q1 release, management highlighted multiple times that they are not seeing much needed traffic in their stores. At the same time stores still hold a lot of Alessandro Michele designed carry-over collections – items that are not on trend anymore.

While the rollout of the new collections’ items should be picking up until end of Q2, it seems we still have to wait until End of 2025 to get a fully immersive feeling for the new identity in the retail space. Hurry up guys…

Throughout the portfolio, all Kering brands have been very designer-centred and creativity-led in its flourishing period from 2015-2021. Michele (Gucci), Demna (Balenciaga), Slimane & Vaccarello (Saint Laurent), Lee & Blazy (Bottega Veneta) – the designer’s names are more present and more linked to their respective brand’s aesthetic than in other brands. Right now, customers are willing to pay the ever increasing premium only for luxury goods that they perceive as truly eternal and with an ever-turning designer carousel the creative directors name does not signal stability.

Conclusion: Entering the era of brand

As projected in my article on heritage re-connection, we are entering the era of long-term desirability. We are entering the era of brand. What’s important in that era are the brand name and brand proposition. What’s less important is a current designer’s name and a current creative proposition. Marketing initiatives should focus on compellingly conveying what the brand stands for, why the brand is relevant to consumers and give a sense of how the brand will guarantee stable long-term desirability. Projecting past appeal into the future should be the first-choice strategy for brands with a strong legacy. Unfortunately, brands are trying to elevate themselves merely through raising prices. That’s misguided! Tell the story, let customers dream, then they will come back and pay the mark-up. Just marking-up will only lead to creative confusion. The fashion industry might be about numbers, but fashion itself is not. Consumers of ultra luxury and high priced fashion might be the target but they are also autonomous agents. In the long run they will rally around deeply desirable brands.

To conclude my Q1 outlook with some optimism: I am looking forward to many exciting and compelling brand stories in 2024.

navigate the noise with me and be first to read the latest articles